5 Steps to Structure Your Financial Processes with Automation and AI

Financial automation doesn't start with the tool. See the 5 steps to structure scalable, governable financial processes ready to operate with AI.

5 Steps to Structure Your Financial Processes with Automation and AI

Financial automation has reached a new stage of maturity. What was once seen merely as a way to reduce manual labor has become a structural element of financial operations. In companies growing in complexity, the difference between an efficient finance department and a chaotic one rarely lies in the team's effort; it is primarily in how processes are designed to handle volume, exceptions, and decisions.

In this context, artificial intelligence does not emerge as a magic solution but as an accelerator. It amplifies both efficiency and existing problems. Therefore, structuring financial processes has ceased to be a best practice and has become a condition for scalable control.

Below, we present five fundamental steps to build a finance department prepared to operate with automation and AI sustainably.

Step 1: Understand Where the Process Truly Breaks Down

Before automating anything, it's crucial to look beyond the "official" design of financial processes: the one typically found in manuals, flowcharts, or internal presentations. In practice, processes like accounts payable, reconciliations, and monthly closing rarely happen exactly as documented. They incorporate exceptions, shortcuts, and informal decisions that only surface in day-to-day operations.

Observing the real process means tracking the actual path of documents and decisions: invoices arriving via email, WhatsApp, and different portals; validations relying on someone's tacit team knowledge; approvals delayed because clear criteria or responsible parties are undefined. It is in these deviations between the "on paper" process and the real process that the main bottlenecks emerge.

These bottlenecks rarely appear in formal reports. They manifest as constant rework, recurring closing urgencies, and dependence on specific individuals to "unblock" stages. This is why accounts payable, financial reconciliations, and monthly closing are often the first targets for automation. In these areas, small failures propagate quickly and compromise the reliability of the numbers.

How to prioritize which financial processes to automate: the Financial Prioritization Matrix

Identifying bottlenecks does not mean that all of them should be automated at once. Once friction points become visible, the most strategic question emerges: where should we start?

This is where many financial automation initiatives lose focus. Without clear prioritization criteria, teams tend to automate what is easiest rather than what truly matters — or, on the other extreme, they start with projects that are too large and risky, generating little return and internal frustration.

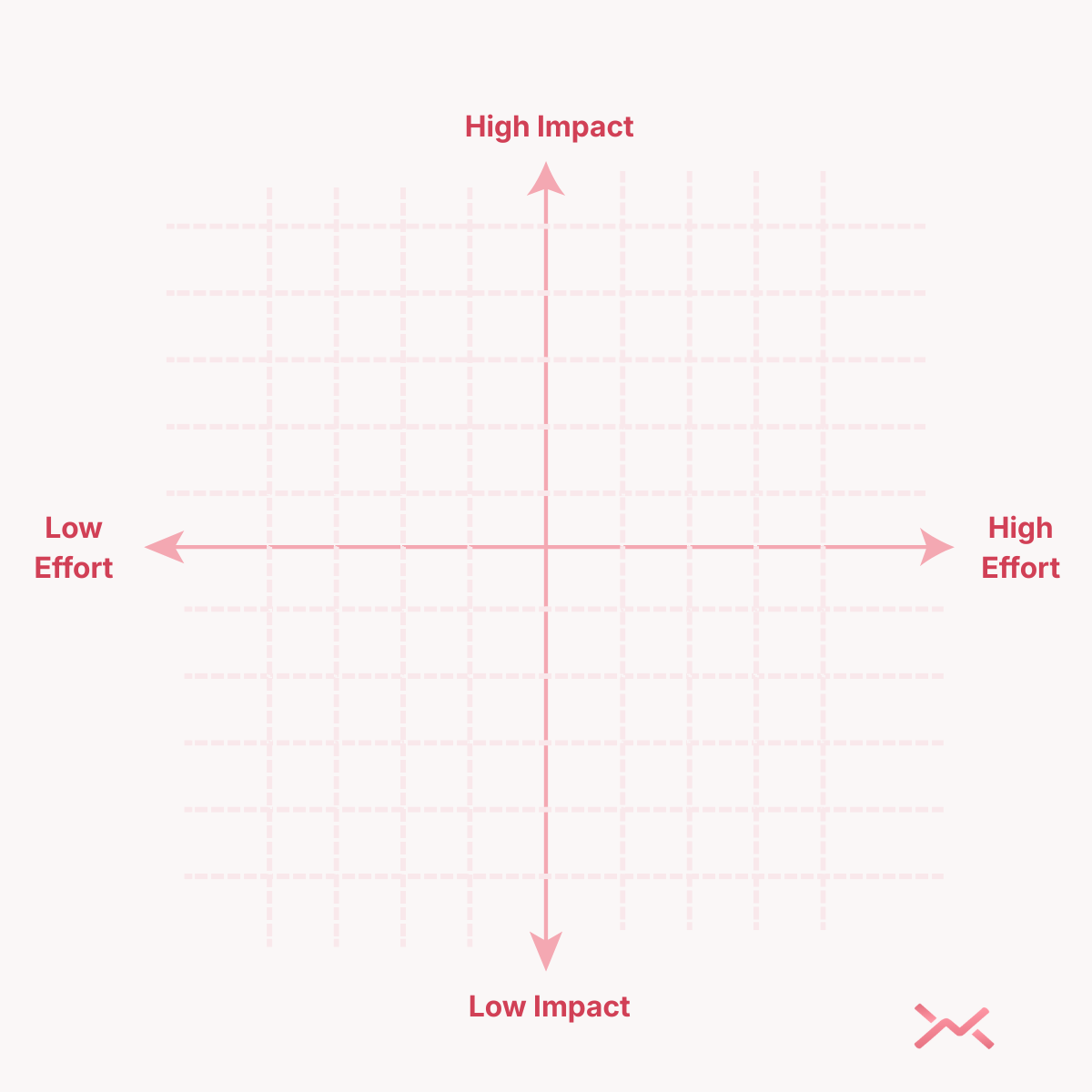

A practical way to avoid this is to use a Financial Prioritization Matrix, which evaluates each process across three complementary dimensions: impact, effort, and risk.

Impact answers the question: if this process is automated, what meaningfully changes in the financial operation? This usually includes hours saved (FTE reduction), fewer errors, improved metrics such as DSO, faster closing cycles, or reduced penalties and rework.

Effort assesses the real cost of implementation, considering rule complexity, data quality, time to implement, integrations required, and tool or infrastructure costs.

Risk acts as a survival filter. It answers a simple but critical question: if this automation fails, what happens?

Processes with high financial exposure, fiscal implications, or direct impact on strategic customers require tighter controls and often human-in-the-loop. Low-risk processes, on the other hand, can operate with higher levels of autonomy from the start.

In practice, the best candidates for automation are not necessarily the simplest ones, but those that combine high impact, manageable effort, and well-understood risk. This approach allows finance teams to build automation progressively, learn from early wins, and gain internal trust before advancing to more critical processes.

Using a matrix like this turns financial automation into a strategic decision, not a sequence of isolated bets.

Step 2: Make Rules and Data Explicit Before Automating

Identifying bottlenecks shows where the process fails. The next step is to understand why it fails. In most cases, the problem isn't just the volume of work but the absence of clear rules to guide the process when variations and exceptions arise.

After mapping where the workflow gets stuck, it's common to discover that many operational decisions rely on informal knowledge: someone “knows” how to classify an expense, someone “usually” approves a certain type of invoice, someone “typically” adjusts data before closing. As long as this knowledge remains implicit, any attempt at automation will be limited.

Making rules and data explicit means transforming these recurring decisions into clear, documented criteria integrated into the process. Financial classifications, approval criteria, validations, and exceptions must move beyond existing only in people's minds and become part of the operational structure.

This effort is not aimed at rigidifying operations but at making them understandable, replicable, and auditable. When data is not standardized, AI merely scales inconsistencies. When rules are not clear, automation amplifies noise. Therefore, structuring financial processes inevitably involves this work of explicitation.

Step 3: Separate Operational Execution from Strategic Decision-Making

Once rules and data are clear, a fundamental distinction emerges: what should be automated as execution and what should remain as human decision. Many financial automation projects fail by attempting to treat these two layers in the same way.

Operational tasks such as validations, checks, consolidations, and forwarding benefit enormously from automation. These are repetitive activities, based on defined criteria, and consume time without adding intelligence to the process. Decisions involving risk, prioritization, significant exceptions, or context interpretation, however, remain essentially human.

This is where artificial intelligence is often misunderstood. Its greatest value is not in replacing financial judgment but in acting as a support layer: organizing information, pointing out inconsistencies, suggesting classifications, and preparing analyses. When well applied, AI enhances the team's decision-making capacity.

This model frequently appears in successful financial automation initiatives with AI agents, where execution follows deterministic and auditable flows, while AI acts at points of variability. Clearly separating these roles is what allows scaling without losing governance.

Step 4: Integrate Automation and AI into the Workflow, with Traceability

After separating execution and decision, the next risk to avoid is fragmentation. In many finance departments, automation emerges in parallel: chats used to "help" with classifications, external spreadsheets for manual adjustments, isolated scripts to solve specific problems. These shortcuts create apparent speed but weaken control.

In financial processes, automation outside the workflow comes at a high price. Lack of traceability complicates audits, compromises the reliability of numbers, and makes it impossible to answer basic questions about decision history.

Structuring financial processes with automation and AI requires everything to happen within the operational workflow, with clear records of what was done, when, and based on which rules. AI needs to be governed, not just utilized.

It is this approach that platforms like Abstra make practical, integrating deterministic automation and AI directly into financial processes, with a complete and auditable history.

In the case of Mercos, accounts payable automation was integrated into the financial workflow, reducing verification and classification time without losing control over exceptions and approvals. As Carlos Marian, the company's CFO, summarizes:

“What we saw with Abstra was not just automation; it was intelligence embedded in our financial workflows.”

Carlos Marian, CFO – Mercos

👉 See the full case study at here

Step 5: Transform Automation into Financial Team Capability

When automation begins to operate within the workflow, with clear rules and traceability, a new challenge emerges: how the finance team works with this new reality. At this stage, the risk is no longer technical but organizational.

In many cases, even with automated processes, finance continues to operate reactively, treating automation as something "resolved." More mature teams advance when they start using automation as a basis to rethink routines, responsibilities, and priorities.

Analysts shift their energy from execution to working on the process itself: they analyze exceptions, question rules, adjust workflows, and identify new opportunities for improvement. Finance stops executing processes and starts governing them.

This shift doesn't turn the team into technicians but develops fluency in processes, data, and automation. The result is a finance department that is less operational and much more strategic.

Why Choose Abstra to Structure Your Financial Processes

After going through these five steps, it's clear that the difference between automating tasks and structuring financial processes lies in the ability to translate operational reality into clear, governable, and evolving workflows.

Rigid tools work in predictable scenarios but fail when the business grows or deviates from the standard. Abstra was built to allow finance teams to model their real processes, combine deterministic automation with AI, and maintain control even in complex environments.

At Abstra, the impact of automation was evident in predictability. In a high-volume, rapid-decision environment, the biggest gain wasn't just speed but confidence in the numbers. As Marcos from Onfly summarized:

“The greatest value is the peace of mind knowing that the process is automated and won't be delayed — the number I see is the real number.”

In both cases, the differentiator was not just technology, but the ability to design tailored financial processes, evolve them over time, and integrate AI with clear rules.

👉 Talk to our experts and see how to structure your financial processes with Abstra

Conclusion

Financial automation doesn't start with technology. It begins with how processes are conceived. AI and automation accelerate this movement but do not replace method, clarity, and operational discipline.

Companies that follow these five steps build a more predictable, reliable finance department prepared for growth. In this scenario, automation ceases to be a promise and becomes a structural competitive advantage.

Abstra Team

Author

Subscribe to our Newsletter

Get the latest articles, insights, and updates delivered to your inbox.