Finance in 2026: Automation, AI, and the End of Operational Chaos

Finance in 2026 demands more than technology. See how CFOs are using automation and AI to gain speed, governance, and strategic clarity.

Finance in 2026: Automation, AI, and the End of Operational Chaos

Finance has entered a new phase and is undergoing a silent—but structural—transformation. Financial automation and the use of artificial intelligence are no longer isolated initiatives. Starting in 2026, they define companies’ real ability to scale with control, speed, and governance.

Organizations that still treat automation as isolated projects or AI as experimental layers are already feeling the impact: slower decision-making, reduced predictability, and increased operational risk in an increasingly volatile environment.

This shift repositions the role of finance within the company. The function moves away from a backward-looking posture and takes on a central role in capital allocation, scenario analysis, and strategic decision support. In this context, the CFO leads the transformation, supported by reliable data, disciplined automation, and AI applied with governance.

Below, we explore a practical and realistic journey to prepare finance for the challenges and opportunities of 2026.

Why change now? The 2026 context

A structurally more unstable environment

The global economic environment in 2026 is marked by persistent uncertainty—currency volatility, inflationary pressures, and frequent regulatory changes. In this scenario, finance’s ability to respond quickly and with clarity becomes critical to both survival and growth. The environment in which finance operates has permanently changed due to factors such as:

- Geopolitical and economic volatility, impacting FX, credit, costs, and supply chains in increasingly shorter cycles

- Accelerated technological obsolescence: tools and architectures become outdated in just a few years

- Growing regulatory pressure, particularly Brazil’s tax reform, which adds new layers of operational complexity

In this context, slow planning is not conservative. It is risky.

The most common trap: believing AI solves everything on its own

Many companies have already adopted artificial intelligence in finance. Few, however, can demonstrate consistent ROI.

The reason is simple: AI without operational discipline doesn’t create efficiency—it amplifies chaos.

Inconsistent data, broken processes, and ungoverned usage lead to what is now known as Shadow AI: parallel automations that are fragile and impossible to audit.

At this point, the conversation shifts from simply “adopting AI” to how to structure finance to operate with speed, predictability, and reliable data in an increasingly volatile environment. Technology stops being the centerpiece and becomes the outcome of a more mature operating model.

From this realization emerge the key trends in financial automation for 2026—less focused on new tools and more on how finance must operate to extract real value from automation and artificial intelligence.

Key trends in financial automation for 2026

After years of fragmented technology adoption, finance enters a phase of consolidation. The trends for 2026 reflect this shift: less emphasis on isolated automation and more focus on an operating model capable of sustaining speed, governance, and decision-making in volatile environments.

Below are the movements likely to become standard in the coming years.

1. Speed as a strategic priority

Traditional financial planning, based on rigid annual cycles, gives way to more dynamic governance models and continuous scenario planning. In a world of constant uncertainty, the ability to revise decisions quickly becomes just as important as the decision itself.

To enable this, finance must:

- Update forecasts more frequently

- Test assumptions and scenarios with agility

- Respond to external changes without freezing operations

In this context, financial process automation moves beyond operational efficiency and becomes a mechanism for strategic responsiveness.

2. The CFO as a strategic technology leader

As finance takes on a more central strategic role, the CFO becomes the main orchestrator of transformation. In 2026, this role manifests across four complementary dimensions:

Strategic decision-maker

Allocates capital and defines priorities based on data, simulations, and advanced scenarios.

Innovation catalyst

Pragmatically integrates automation, artificial intelligence, and cloud technologies into financial routines.

Business partner

Works alongside other departments to unlock growth through applied financial insight.

Guardian of governance

Ensures compliance, security, and data reliability in an increasingly complex regulatory environment.

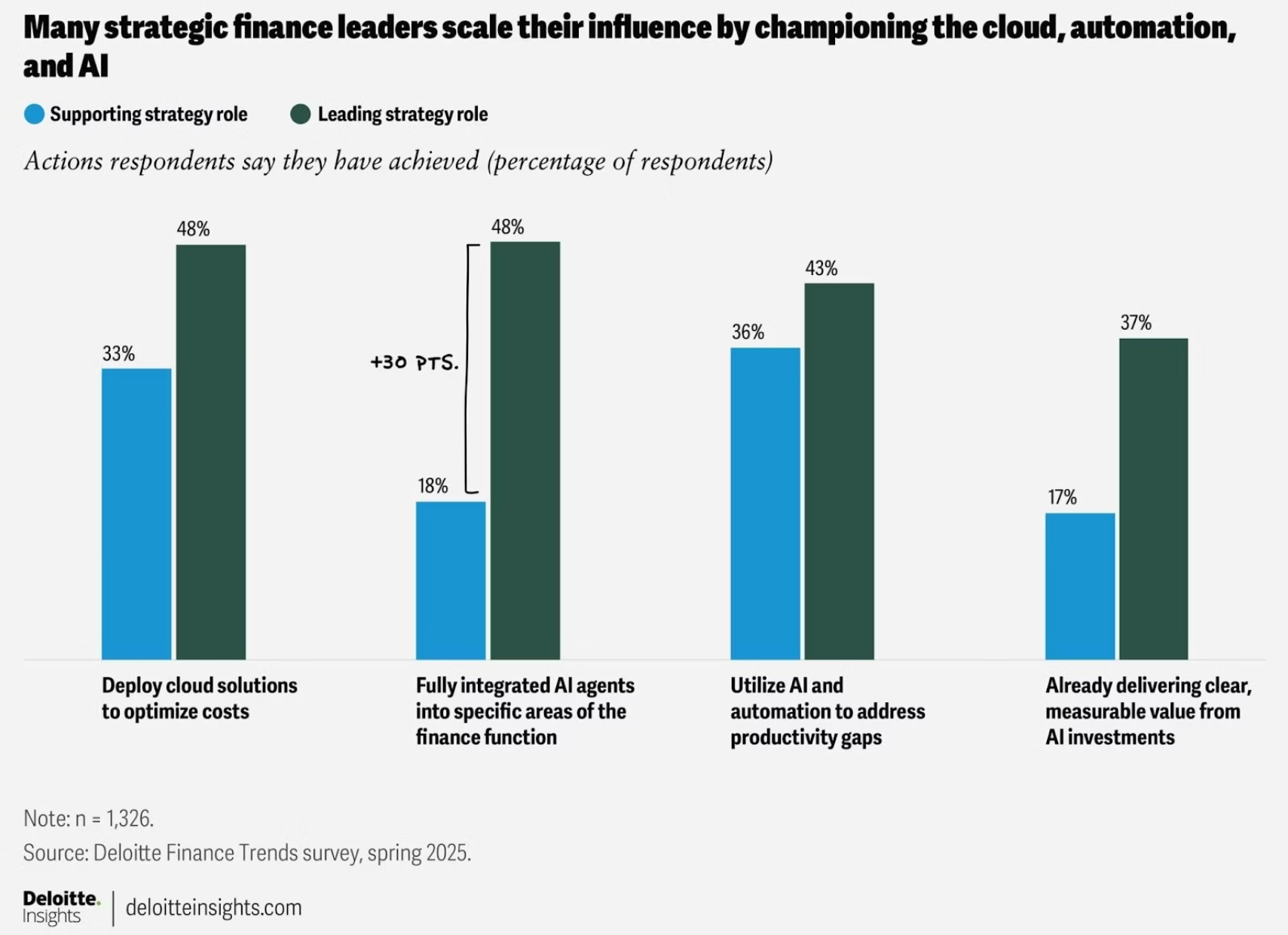

According to the Deloitte Finance Trends Survey, finance leaders with this profile:

- Are almost 3x more likely to already use AI agents (48% vs. 18%)

- See clear ROI from AI initiatives, while only 17% of traditional models achieve the same

3. Financial discipline that creates value

The pressure for efficiency remains high, but the focus changes. In 2026, cost management moves away from across-the-board cuts and becomes a continuous exercise in intelligent resource allocation.

Financial automation enables organizations to:

- Make previously hidden waste visible

- Simulate impacts before decisions are made

- Prioritize efficiency that sustains growth—not just expense reduction

Without reliable data and structured processes, cost-cutting decisions rely on perception. With automation and governance, they rely on evidence.

4. The era of AI agents in finance

Advances in AI are driving finance toward the adoption of autonomous agents—systems capable of executing tasks, making limited decisions, and interacting continuously with other systems.

The core challenge is no longer technical. Building agents is relatively easy. The real challenge is delivering real ROI with security, control, and auditability.

This is where the hybrid architecture becomes standard: Intelligent automation = Deterministic workflow + AI agent

This combination brings together operational precision and the flexibility needed to handle real-world exceptions.

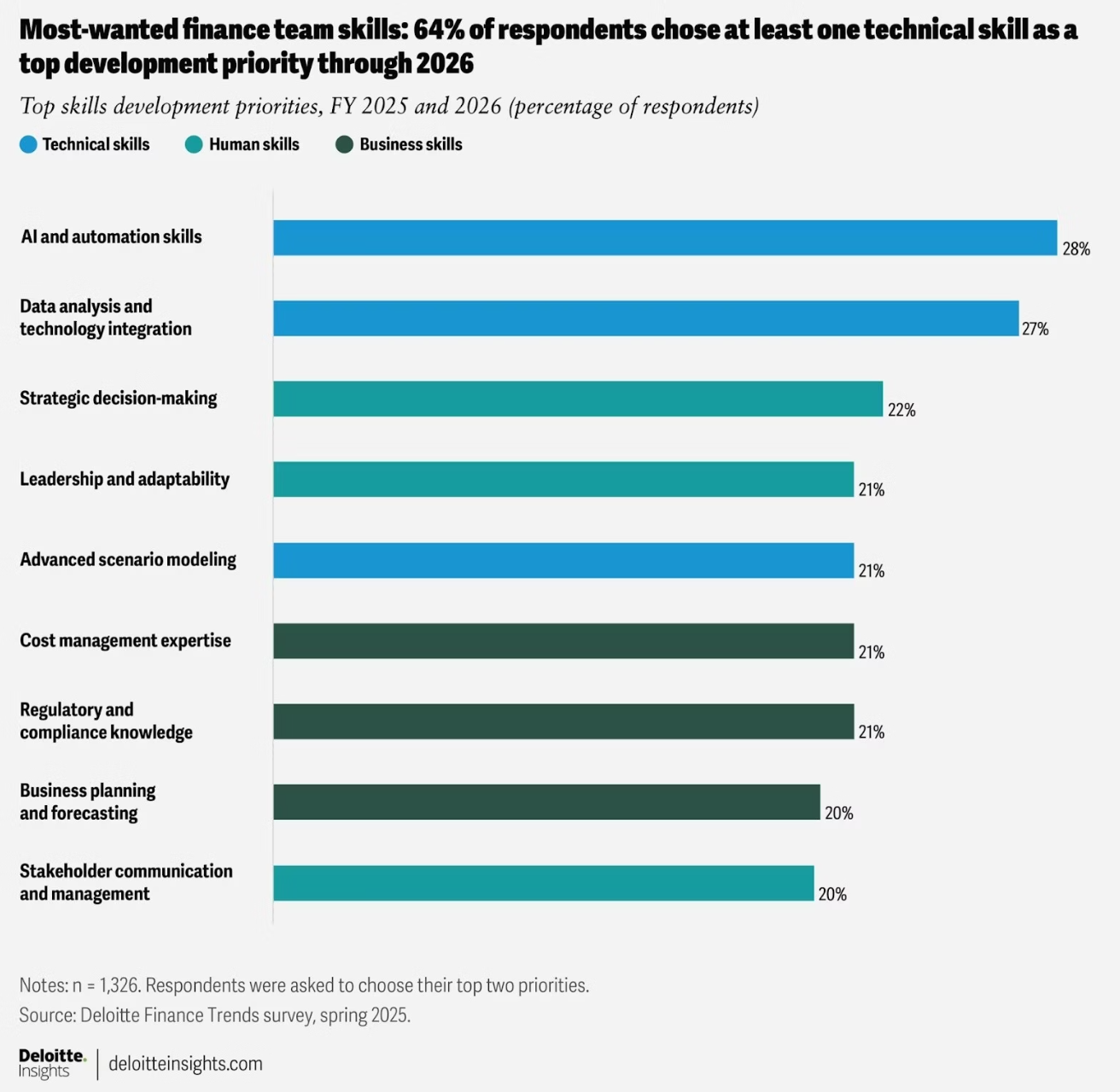

5. The hybrid professional: finance and technology

Finance transformation doesn’t happen through systems alone—it happens through people. The biggest change is human.

The market increasingly demands professionals who combine:

- Strong financial reasoning

- An understanding of data and processes

- Comfort with automation and artificial intelligence

Today, skills related to AI and automation already surpass traditional finance competencies in market relevance. In this context, one trait becomes essential:

“Curiosity is the most important skill of the modern finance professional.”

It defines the ability to learn, test, adapt, and evolve alongside technology.

The biggest trap: automating without fixing the foundation

As discussed earlier, artificial intelligence does not fix structural problems. It amplifies what already exists—for better or worse.

In practice, the most common failures in financial automation follow a familiar pattern:

- Inconsistent data, which causes errors to scale faster

- Poorly defined processes, which simply automate disorder

- Shadow AI, with no governance, traceability, or auditability

As Bill Gates famously summarized:

“Automation applied to an efficient operation magnifies the efficiency.

Automation applied to an inefficient operation magnifies the inefficiency.”

Avoiding this trap requires less new technology and more method. Three questions must be answered before any advanced automation:

1. Where is the waste?

Mapping bottlenecks using Lean Finance principles (rework, waiting, excessive reporting, manual data entry, and system hopping) quickly reveals the best candidates for automation.

2. Is the data ready to scale?

Before automating, information must be:

- digitized,

- structured,

- standardized, and reliable.

When data is wrong, the work is not automation—it’s data cleanup.

3. Which technology solves this specific problem?

- Structured processes require deterministic workflows, with clear rules and total precision.

- Unstructured processes require AI agents, capable of interpreting real-world variation.

In practice, the most effective model is hybrid:

deterministic control for execution + AI for interpretation.

Conclusion: 2026 is about operational maturity

Financial automation and artificial intelligence are not shortcuts. They are strategic levers when applied on top of well-defined processes, reliable data, and clear governance.

Organizations that start now build an advantage that is hard to replicate:

- they operate faster,

- reduce operational risk,

- and turn finance into an active driver of decision-making and growth.

The future of finance does not eliminate people — it elevates their role.

Professionals move away from repetitive execution and toward supervising decisions, analyzing scenarios, and shaping strategy, supported by automation, data, and artificial intelligence applied with discipline.

👉 Talk to our experts at Abstra

Watch Catarina Pinheiro’s Class on Automation and AI in Finance for 2026

Abstra Team

Author

Subscribe to our Newsletter

Get the latest articles, insights, and updates delivered to your inbox.