Abstra vs Power Apps for Finance: A Complete Comparison, Advantages, and Risks.

Abstra vs Power Apps: A complete comparison for finance teams. Understand the advantages, limitations, risks, and which platform offers real automation in finance.

Abstra vs Power Apps for Finance: A Complete Comparison, Advantages, and Risks.

Financial automation is no longer a trend; it has become the inevitable future for modern finance teams. In a landscape where efficiency, reliability, and real-time data are essential, teams still relying on spreadsheets, manual processes, or fragile integrations cannot keep pace with business demands or deliver strategic value.

That's why platforms like Abstra and Power Apps have moved to the center of discussions among CFOs and Financial Operations leaders — yet the day-to-day impact of each solution is vastly different.

This guide provides a comprehensive, straightforward comparison, highlighting the advantages, limitations, and risks of each platform within the context of corporate financial operations.

What is Power Apps?

Microsoft Power Apps is a low-code/no-code platform for creating internal applications, forms, approvals, and simple automations.

It works very well within the Microsoft ecosystem — especially for companies already using:

- Office 365

- SharePoint

- Dynamics

- Dataverse

- Power BI

However, when finance teams need to deal with:

- Complex rules and calculations

- Advanced reconciliations

- Integrations with ERPs and banks outside the Microsoft ecosystem

- High data volumes

- Workflows with AI validations and exceptions

- Rigorous auditing and governance

The limitations of Power Apps become apparent.

What is Abstra and How Does It Drive Financial Automation?

Abstra is a Python-first platform with integrated AI, designed to empower finance teams to automate complex workflows, eliminate manual tasks, and connect data rapidly — with corporate governance and scalability.

The platform combines:

- Python as a native language

- AI for app creation, automations, and analytics

- Open connectors for ERPs, banks, APIs, and legacy systems

- Secure, scalable, and auditable infrastructure

- Real autonomy for finance teams, with low IT dependency

This set of capabilities positions Abstra as the natural choice for companies demanding precision, flexibility, and security in critical financial operations. It's no surprise that CFOs from companies like Mercos are already seeing results: a 70% reduction in accounts payable work after automating invoice processing using Abstra.

“What we saw with Abstra wasn’t just automation; it was intelligence embedded into our financial workflows.”

— Carlos Marian, CFO – Mercos

When Low-Code Isn't Enough for Finance

Low-code tools like Power Apps work well for simple workflows:

- Internal forms

- Approvals

- Registrations

- Administrative requests

But the reality of modern finance includes:

- Multivariate reconciliations

- Advanced financial calculations and models

- Integrations with multiple ERPs and banks

- AI-powered automations for risk, forecasting, and anomalies

- High transaction volumes

- Processes requiring full traceability

These scenarios demand flexibility and advanced logic — something Power Apps struggles to scale.

Abstra naturally adapts to this complexity.

Complete Comparison: Abstra vs Power Apps for Financial Operations

Below is a direct comparison between Abstra and Power Apps, focused on essential criteria for corporate financial operations.

Strategic Differentiators

Value Proposition

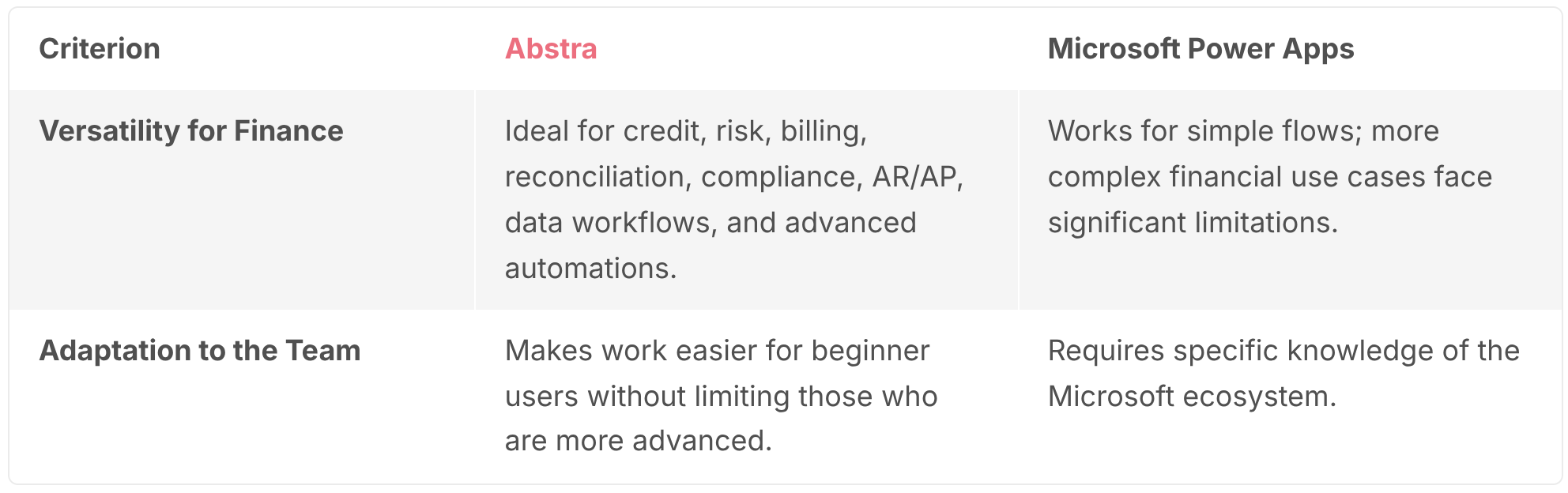

Abstra offers a more direct path to transforming financial rules and calculations into real systems, thanks to its Python-first model and AI that automatically generates code, integrations, and automations.

Power Apps, on the other hand, relies on visual construction, which works for simple workflows but quickly becomes limited and cumbersome when the process involves validations, exceptions, and complex financial logic.

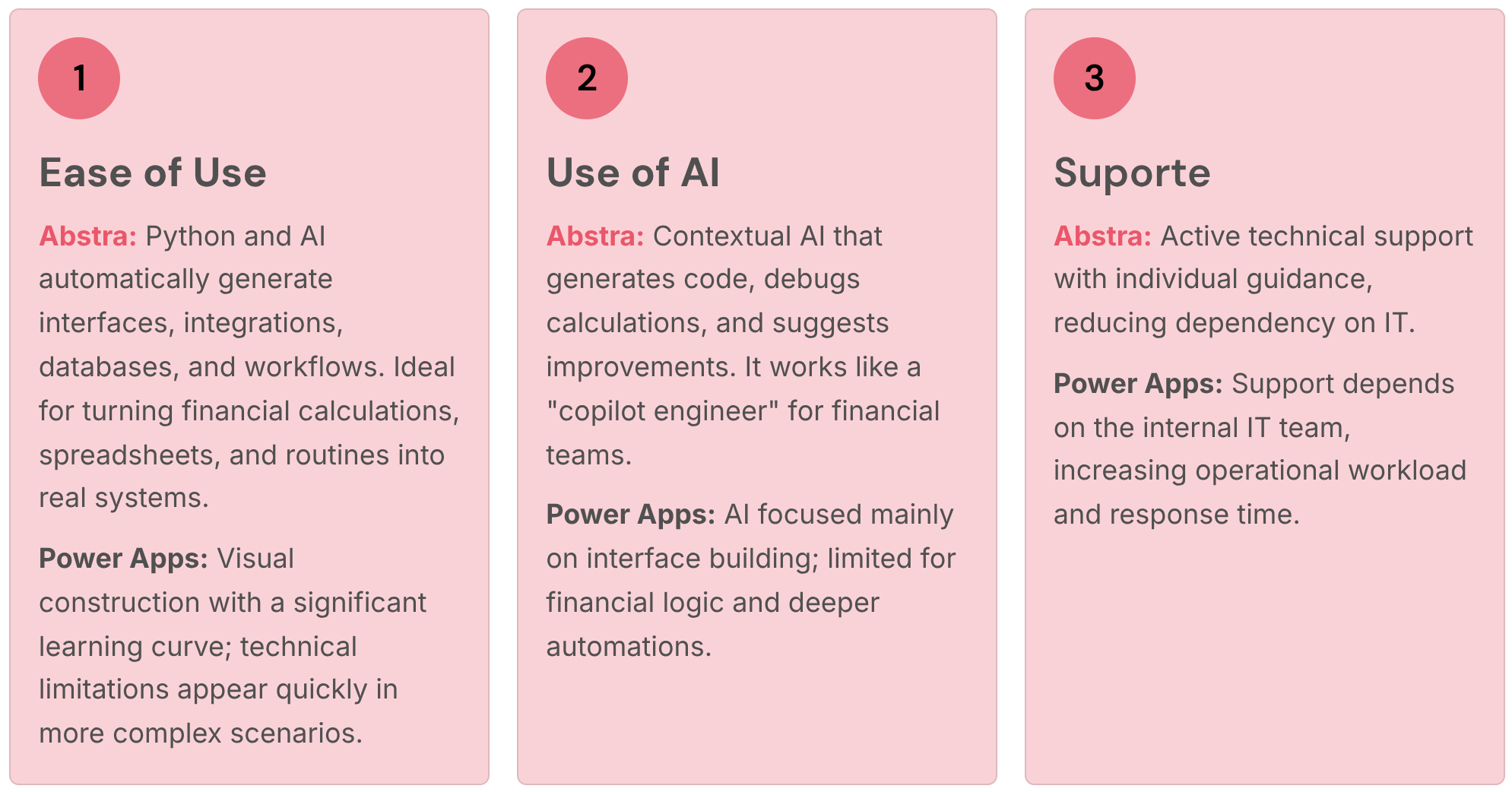

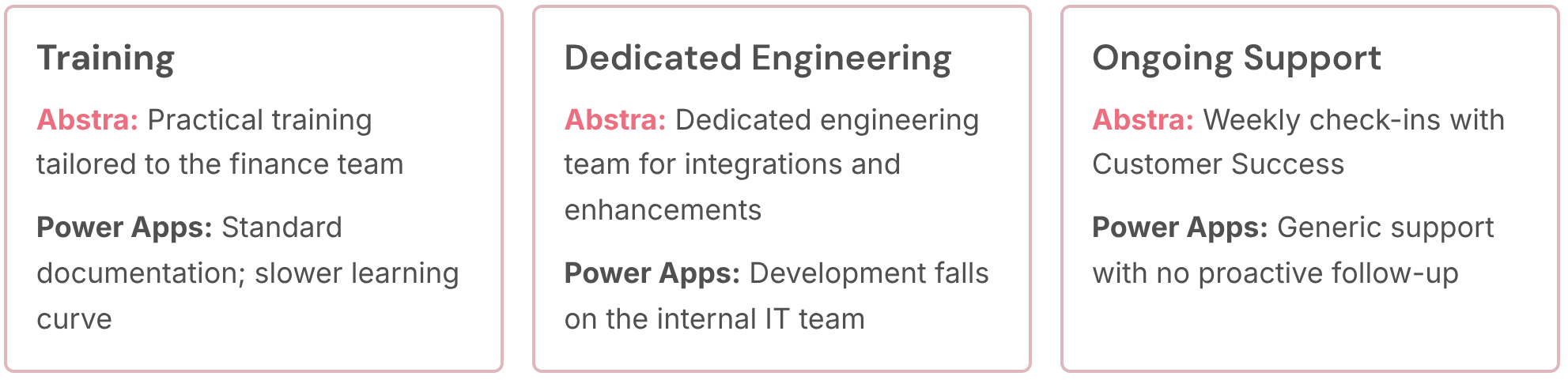

In practice, Abstra is more intuitive for creating advanced workflows, features contextual AI capable of generating and debugging code, and provides close support with dedicated engineering. Power Apps, conversely, has a steeper learning curve, a more generic AI focused only on interfaces, and relies on internal IT for adjustments and maintenance.

Flexibility

Abstra easily adapts to diverse financial realities — accounts payable automation, accounts receivable management, financial reporting and analysis, expense management, planning, and bank reconciliation — enabling finance teams to create robust and complete automations.

In Power Apps, flexibility diminishes as complexity grows, as the visual model doesn't scale well for more in-depth financial workflows.

Integration

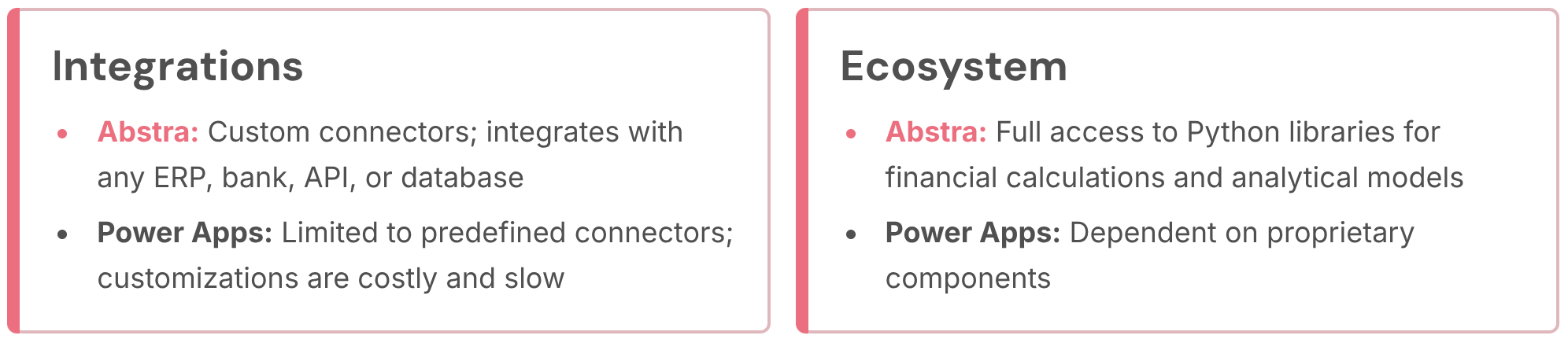

With open connectors, full access to the Python ecosystem, and the ability to integrate any ERP, bank, API, or database, Abstra naturally fits into multi-system financial operations.

Power Apps, on the other hand, relies on proprietary connectors and restrictions within the Microsoft ecosystem, making integrations outside this universe more difficult and costly.

Future-Proofing

Investing in technology is investing in the organization's future. The choice of a platform should consider not only current needs but also its capacity for evolution, adaptability to market changes, and long-term technical sustainability.

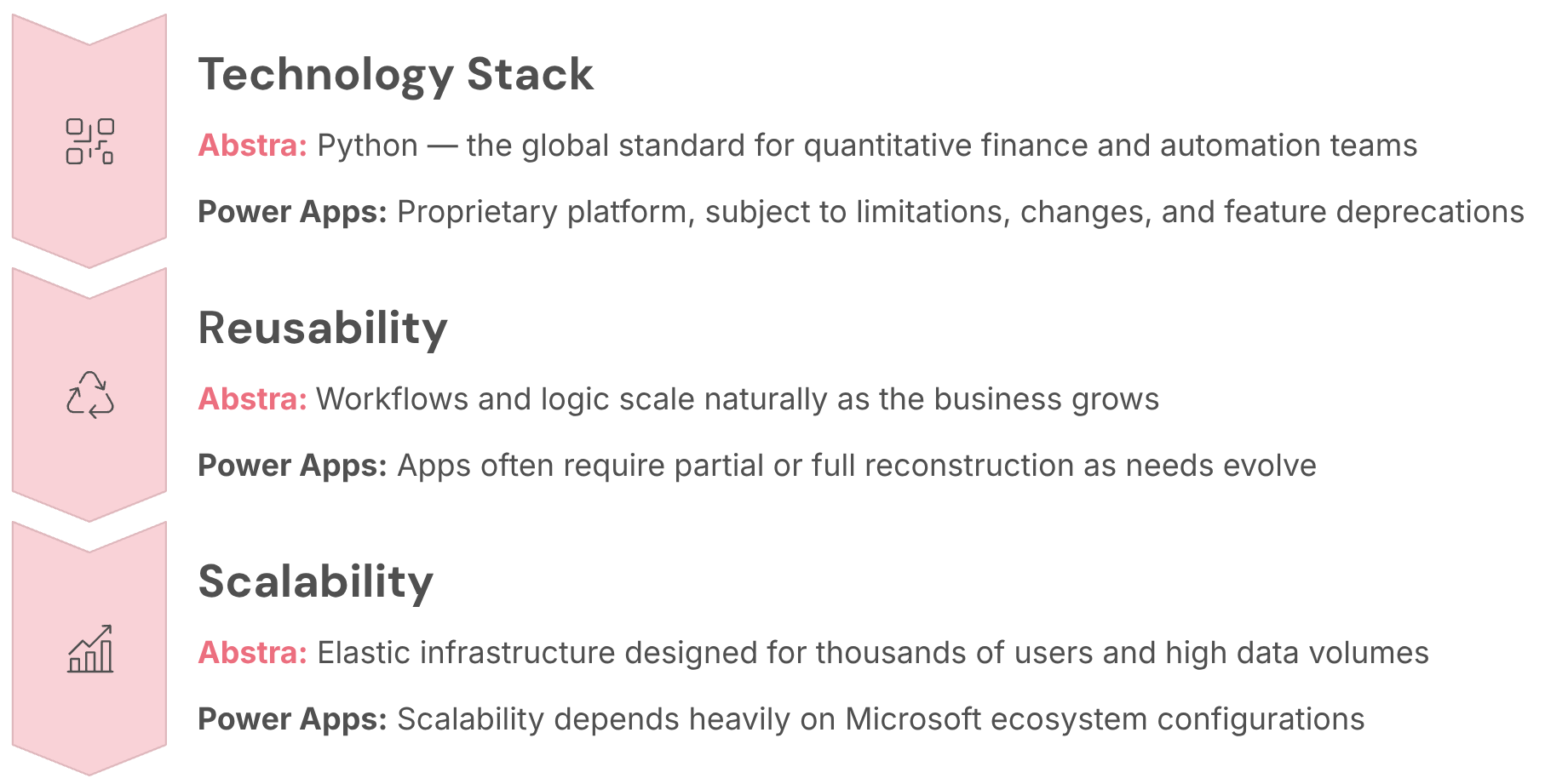

With this in mind, Abstra was built on Python — a global standard in automation and for quantitative finance teams — which ensures longevity, scalability, and ease of maintenance.

Power Apps, being based on proprietary technology, depends on Microsoft's decisions, is subject to limitations, and may require rebuilding as the business evolves.

Support

Abstra ensures active support with technical specialists and Customer Success closely monitoring each stage, accelerating evolution and ensuring stability in critical financial workflows.

With Power Apps, this responsibility falls entirely on internal IT, creating backlogs, increasing dependency, and reducing agility for adjusting or scaling processes.

Conclusion: Which Platform Makes More Sense for Financial Operations?

Power Apps works well for simple cases, within the Microsoft ecosystem, and for processes with low complexity.

Abstra, on the other hand, is the ideal choice for finance teams that need:

- Advanced automation,

- Complex logic and calculations,

- Multiple integrations with ERPs, banks, and APIs,

- AI applied to real tasks,

- Corporate governance and auditing,

- Scalability,

- Massive reduction in manual work. For financial departments seeking efficiency, reliability, and operational autonomy — without relying on spreadsheets and without overburdening IT — Abstra offers an unparalleled leap in productivity.

Transform Your Financial Processes with Real Automation Today!

Ready to see how AI + Python can eliminate manual work, reduce errors, and accelerate your financial routines?

👉 Speak with our team: https://www.abstra.io/pt/falar-com-especialista

Abstra Team

Author

Subscribe to our Newsletter

Get the latest articles, insights, and updates delivered to your inbox.